The online banking app built for growth

Kudzu is the online banking app that gives you the tools, support, and peace of mind to spend, save, and plan your financial future—no jargon, no judgment.

Why Kudzu?

Finally, banking that’s on your side

You don’t have to be perfect to make progress. Kudzu helps you build steady financial habits, gain confidence, and grow on your own terms.

The easy way to manage your money

Finances can feel overwhelming. Kudzu puts the tools and resources you need in one simple app.

Take control of your financial future

Kudzu equips you with tools, technology, and training to make the most of your money.

We’re rooting for you

Kudzu is by your side with the trusted support and guidance you need to make smart decisions on your financial journey.

Growth is in your nature

Kudzu combines features that meet you where you are with education to take you where you want to be.

Financial empowerment is in your hands

You deserve an account that works for you. Kudzu replaces clunky budgeting systems with easy-to-use tools.

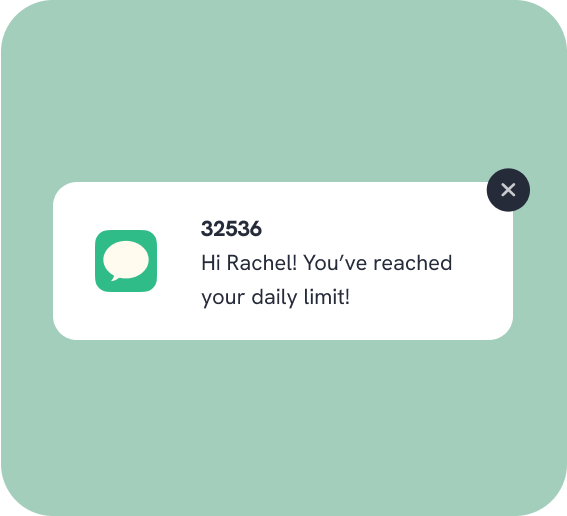

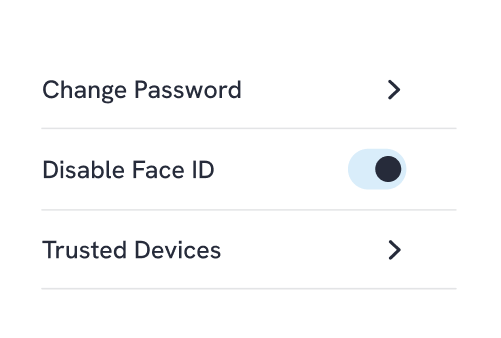

Protect your money. Protect your peace.

You worry enough. The Kudzu online banking app keeps your money safe and your goals on track.

Master your money with simple, powerful tools

Our features were designed for everyday people who want to spend with more clarity, save with purpose, and feel confident every step of the way.

Smarter spending, down to the penny

Keep more of your money with a Kudzu spending account and say goodbye to monthly fees, minimum balances, and overdraft protection fees¹.

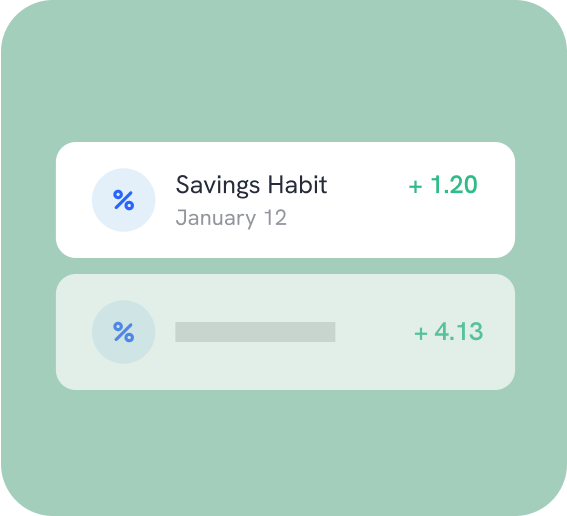

Accelerate your savings, automatically

Put your rainy-day fund on autopilot and watch your interest grow faster than the national average2 with a Kudzu savings account.

Grow further with Kudzu+

Take the next step with elevated tools and enhanced features designed to help you make the most of your money3.

Get paid sooner

Kudzu+ gives you early access4 to incoming direct deposits so you can plan ahead without stress. It’s your money, just a lot faster.

Earn more % on your $

Set and reach your personalized Savings Goals with Kudzu+ thanks to our Annual Percentage Yield (APY) of 1.26%5—well above the national average2.

Do more with your money

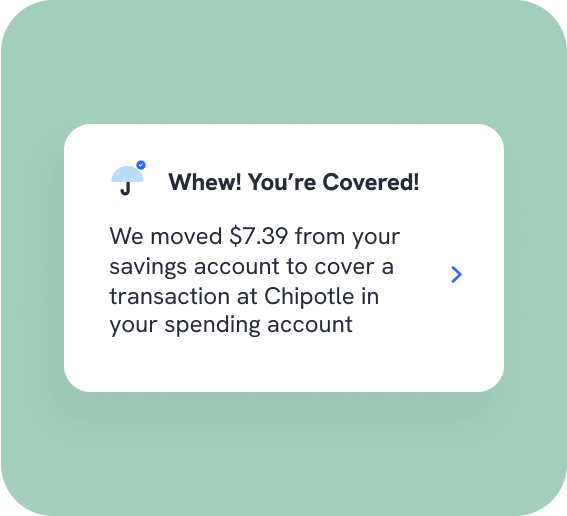

Kudzu+ unlocks the best we have to offer, like more overdraft protection, personalized Savings Goals, and so much more.

The security your money deserves

Your Kudzu account is protected from every angle, including digital encryption, anti-fraud measures, and your funds are FDIC-insured6 through The Bancorp Bank, N.A., Member FDIC.

Learn—and earn—your way to financial freedom

Boost your financial literacy and earn points toward our cash prize sweepstakes7 with PayPerks®, our interactive learning program.

The Kudzu toolkit: built to empower

Designed to help you spend smarter, save with intention, and avoid overdraft fees, the Kudzu toolkit consists of three features that give you full control over your finances.

Want to grow even faster? Sign up for Kudzu+3 and expand your toolkit with two additional features—advanced overdraft protection with Covered by Kudzu+™10 and customizable Savings Goals.

How it Works

Joining Kudzu is simple and fast

There’s no telling how far you’ll grow with Kudzu. Follow these simple steps and get started today.

Step 1: Download the Kudzu app

The first step toward more confident money management is to download the Kudzu app on your Apple or Android device.

Step 2: Submit your enrollment

Signing up is simple. Fill in your information and verify your ID. We'll let you know when your account is ready.

Step 3: Add your new card to your digital wallet

Enjoy instant, secure access to your Kudzu Visa® Debit Card by adding it to your smartphone wallet.

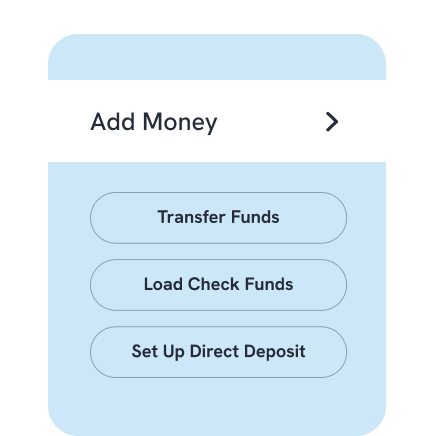

Step 4: Top off your spending account

Funding your account is easy—use direct deposit, bank account transfer, or even mobile check deposit.

Step 5: Receive your physical card

Once you fund your spending account, your physical Kudzu Visa Debit Card will arrive in 7-10 days, ready for use everywhere Visa debit cards are accepted.