Your balance may dip, but your confidence doesn’t have to. Kudzu’s layered approach to overdraft protection1—savings transfers, auto-declines, and spending alerts2—keeps you covered, fee free.

Overdraft fees aren’t just expensive, they’re frustrating and unfair. Kudzu eliminates the stress and anxiety of overdraft penalties ensuring a small mistake won’t turn into a setback.

Life doesn’t always go according to plan, but that doesn’t mean your finances have to fall behind. Kudzu puts you in control so you can respond, recover, and keep moving forward.

When you hit a bump in the road, you deserve banking that gives you grace, not grief. Instead of fees, you can focus on more important things, like building better money habits.

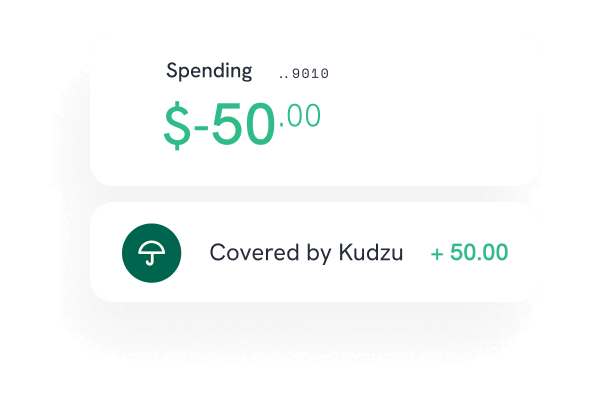

Covered by Kudzu1 is optional, fee-free overdraft protection that can automatically transfer money from your Kudzu savings account to your spending account when your balance isn’t enough to cover a debit card transaction. You’ll need to keep at least $50 in your savings account to be eligible, and the feature can be used up to 10 times per month.

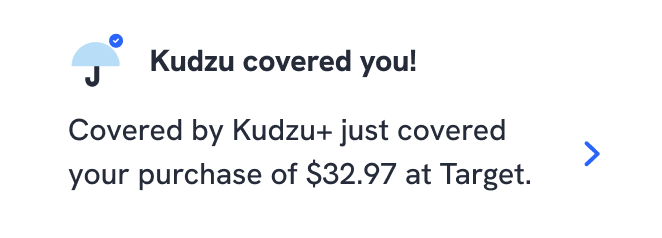

If you’re a Kudzu+3 member, the same robust protection still applies, but with Covered by Kudzu+4 we’ll spot you up to $100 when you’re short on funds—you only repay what we cover. Just make sure you receive at least $100 in qualifying direct deposits each month to stay eligible. There are never any fees, and you control whether the feature is active.

No. Kudzu never charges overdraft fees. Instead, we decline the transaction or activate overdraft protection through Covered by Kudzu1 or Covered by Kudzu+4. Traditional banks charge an average of $35 per overdraft occurrence, even if you’re just a few cents short or if the same charge hits multiple times. We believe you shouldn’t be punished for a financial misstep.

If your savings account balance is too low to cover a transaction, Kudzu simply declines the transaction, no negative balance or fee required. This protects you from overdrafting and prevents unexpected account debt.

Your Covered by Kudzu1 settings are easy to manage in the Kudzu app or online, and you can opt in with just a few taps. Auto-declines are enabled by default. Spending limit notifications with SpendSense Alerts2 are optional, and can be managed and customized in the Kudzu app or online to warn you when you are close to reaching your daily, weekly, and/or monthly spending threshold. Choose between push notification, email, and/or SMS.

Usually, overdraft “coverage” refers to a service where the bank will allow a transaction to clear, even if you don’t have enough money in your account. The bank will charge you a fee for the “privilege” of overdrafting and still require you to bring your balance positive (including the fee).

On the other hand, overdraft “protection” is a service where your spending account is connected to a savings account and funds are automatically transferred to cover overdrafts. If you don’t have enough money in your savings account, the charge will be declined until your balance is high enough to accept it. Some banks charge fees for this service, Kudzu does not. Covered by Kudzu1 is a form of “overdraft protection,” not “overdraft coverage.”

Standard text messaging and/or data rates from your wireless provider may apply.