Kudzu helps you do more with your money—no extra fees, no credit check, just tools and resources to help move you forward—all in one easy-to-use app.

You work hard for your money and, we don’t believe in charging you to use it. With Kudzu, you’ll never pay an overdraft, minimum balance, in-network ATM, or maintenance fee1. At the end of the day, your money is just that—yours.

We aren’t all afforded the same tools and resources in life. At Kudzu, we’ve decided it doesn’t have to be that way. Everyone deserves a chance to grow, so the tools you need to advance your financial skills and confidence are built right in.

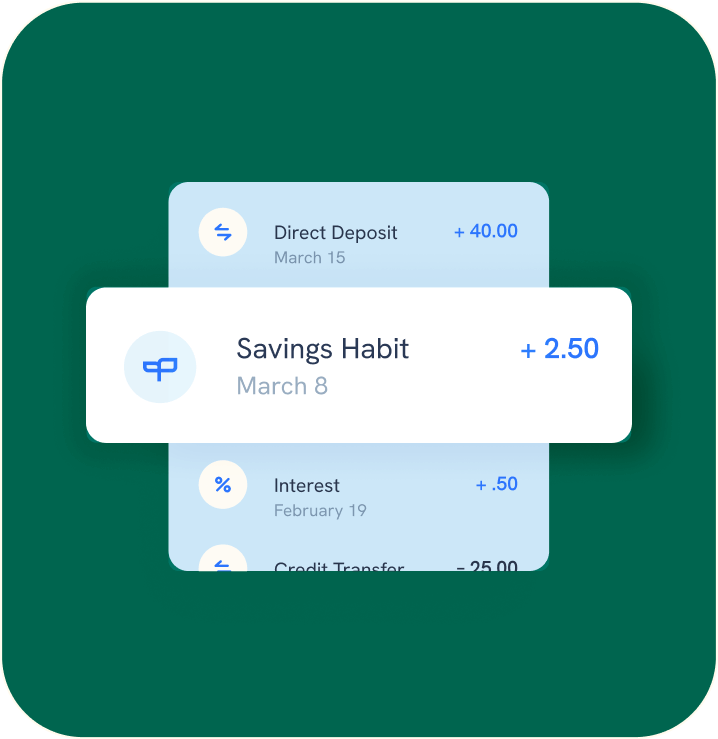

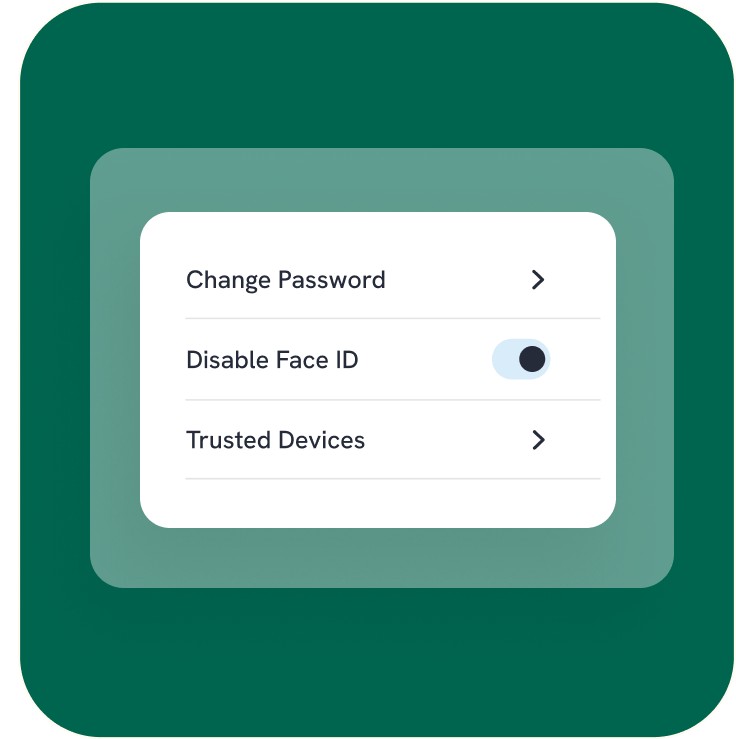

Tracking and assessing your finances can be stressful on its own, never mind juggling multiple apps, spreadsheets, and debts. The Kudzu mobile app gives you a clear view of your finances, plus you can easily make changes, move money around, or improve your skills whenever, wherever.

Standard text messaging and/or data rates from your wireless provider may apply.